They are also referred to as cash or check loans. A payday loan is a sort of short-term loan in which the lender allows a loan at the highest dividend according to your profits. Payday loans charge high interest rates for a short-term emergency loan.

What does it make sense for me to stockpile before I give the application?

To make a loan you will need:

- You must have your checking deposit account open and functional for at least 30 days

- Active and working phone number

- Earnings information from your area of work

- You must show your social security number

- Any document produced by state authorities and attesting to your person with a photograph

Details on the viability of payday loans

The Consumer Financial Protection Apparatus states that 73 percent of payday loans cannot be paid back in the time needed. With Internet borrowers, the conditions are worse. This leads to the fact that the interest price rises appreciably, and the payment you owe rises, which makes it unrealistic to repay it. If the payday loan and taxes are not paid at the specified time, the payday lender can deposit the user's check. There are facts that the user doesn't have enough money in the account to close the cash advance. Depending on the credit criteria, you will be presented to a collection institution or debt collector, and these agencies have the ability to inform the debt reporting firms about you.

Cash advance has become quite prominent in the states. According to the Consumer Financial Protection Bureau (CFPB), in 2015 there were more payday lending locations in 36 states than McDonald's locations in all 50 states. Payday loans are made at payday lending locations or at locations that sell other money services, including check cashing, payday loans, rent-to-own, and deposit, depending on state licensing rules.

Payday loans operate differently than private and other client loans. A customer can own no more than 2 payday loans together, they can't be with the same payday lender, and any loan is limited to $500-$999, not covering fees. Different states have different rules affecting payday loans, which limit the amount of money you can borrow or the amount of money the lender will charge in interest and fees.

Credit score can be ruined if you buy payday loans

An ordinary payday loan does not require a creditworthiness test or indication of your ability to repay the funds. Payday lenders in most cases do not conduct a creditworthiness determination of applicants, therefore the appearance of the request will not be reflected as an unqualified request in your financial review, and they will not introduce the debt reporting institution as soon as you possess it. They additionally usually don't report any information about your payday loan history to state credit firms. Although, in accordance with Experian, these loans can also not help you form your financial way if they are not reported to the debt transaction office as soon as you pay them at the specified time.

But everything is transformed when the credit profile is made unclosed in its own time. On the off chance that you don't liquidate your loan and your lender sends or sells your payday loan obligation to a collection firm, you have to assume that a collection office employee is in a position to put a reputable national lending office on notice of that loan. Then it is capable of damaging your repayment rating under any circumstances. If only that happens, it will remain on your financial record for six to seven years and will be badly imprinted on your debt history. Financial scores are summed up by some variety of banking bureaus based on the information the office concentrates on customers. Failure to pay your bills on time will result in your points dropping, which can have a significant impact on your future loans.

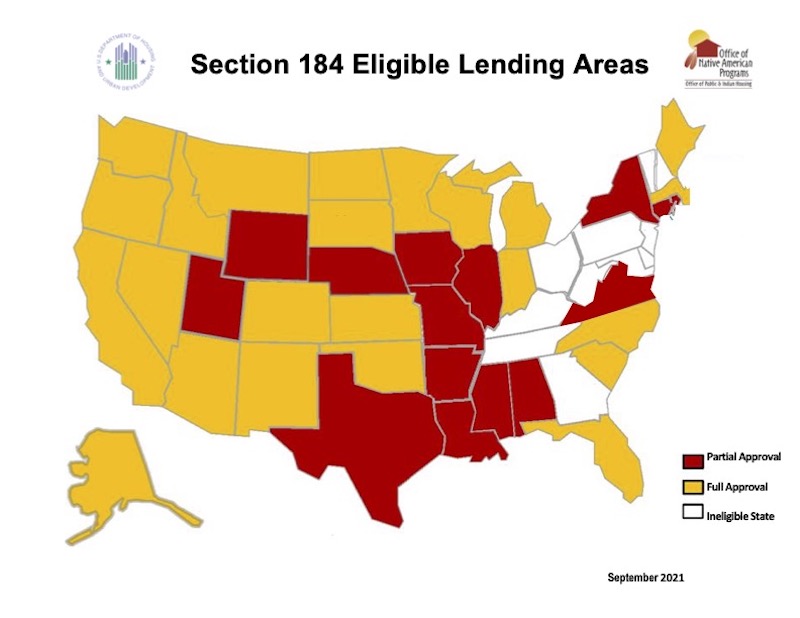

Are cash advances legally recommended in America?

In fact, there aren't many conditions around MCAs because they aren't listed as loans. Web payday lenders are usually subject to state licensing regulations and the highest rates of the state in which the borrower acquires the loan.

High-cost payday lending is allowed by regulations or state ordinances in thirty-two states. All that said, these source of income phenomena can be unsafe for business owners who can't commit to the rules of their own contracts. Certain states have tightened the high interest rates to some extent. Fifteen states and the District of Columbia protect their own people who take out loans from high-cost payday lending through reasonable limits on small microloans or other prohibitions.

What are the best of the best payday loan options?

Sample surveys reveal that 12 million U.S. residents take out payday loans each year, despite many indications that they lead most borrowers into much stronger debt. While people who have taken out payday loans in most cases don't believe they can lend live money elsewhere, there are options they have to discuss.

- Credit counseling

Not trade credit counseling agencies, like InCharge Debt Solutions, offer no-cost advice on how to put in an accountable monthly settlement and get out of debt. In order to determine a debt counseling agency, go to the web, talk to a debt alliance, apartment management worker, or your company's human resources department for recommendations.

- Borrow money from relatives or friends.

Loaning money from loved ones can be a great addition in specific circumstances. Unless you have your back against the wall and a loan from a loved one is the surest way to get out of a bad money situation, borrowing financial resources may be your best option. Meanwhile, borrowing from your kin can still be a double-edged sword. It creates tension in your connections and in the power to activate guilt, resentment and loss of faith.

- PAL or PAL II is a much better opportunity for payday loans

Alternative payday loans, or PALs, allow members of individual federal loan unions to borrow modest amounts of financial resources at a much lower cost than traditional payday loans, and pay back the loan over a much longer period. You can use PAL cash for your own purposes, in order to dodge a payday loan or pay back an existing one. PAL are regulated by the State Administration of Credit Unions, which launched the project in 2009. The maximum interest cost for PALs is 28%, which is about one fourteenth of the cost of a typical payday loan. In 2020, NCUA joined a second draft of the PAL, known as PALs II, which contains similar principles. In addition, debt federations are prohibited from deferring PALs, which means that borrowers with the lowest capacity can get into a predatory credit cycle. Borrowers have the right to extract only one type of PAL together.

Is it allowed to get a payday loan without a debit account at the bank?

Yes. It is not always necessary to have a bank account in order to lend money, but lenders who don't ask for it charge high interest rates in most cases. Yes, and it's a good idea to prove that you have a solid income to repay the loan in any circumstance. Payday lenders will ask for a bank deposit, but sometimes a pre-paid debit deposit may be enough to justify a loan. Not all lenders offer this type of loan, so you will need to do some research to find a reliable lender who will.

If only the lender enrolls your loan application and you don't have a bank account to plan the liquidation, you probably need to establish a program to embody a contribution directly by cash, check, money order. It is preferable to liquidate a short-term loan before the closing date, as a cash loan will conclude costly consequences for not complying with the time of the installment.

Getting a payday loan is obviously more difficult, and even when a lender is inclined to work with you, he may need many times the information and documentation before he feels safe enough to give you cash in kind. The lender will obviously try to make sure that you don't have pending bankruptcy proceedings, pending bills, or intense tax debts to your state. Without a financial account, you are usually curtailed by short-term loans, including quick payday loans with an unenviable repayment rating or a loan secured by property.